It's about a 4 min. read.

This article was originally published in MONEY.

Women are finally changing the conversation about their professional lives. But when it comes to gaining control of their finances, they still find themselves at a disadvantage, according to a new survey from Ellevest, a digital investing platform for women.

“Simply put, women don’t invest as much as men do,” Sallie Krawcheck, the CEO of Ellevest, writes in the latest issue of MONEY. “And they don’t invest as early as men do, either.”

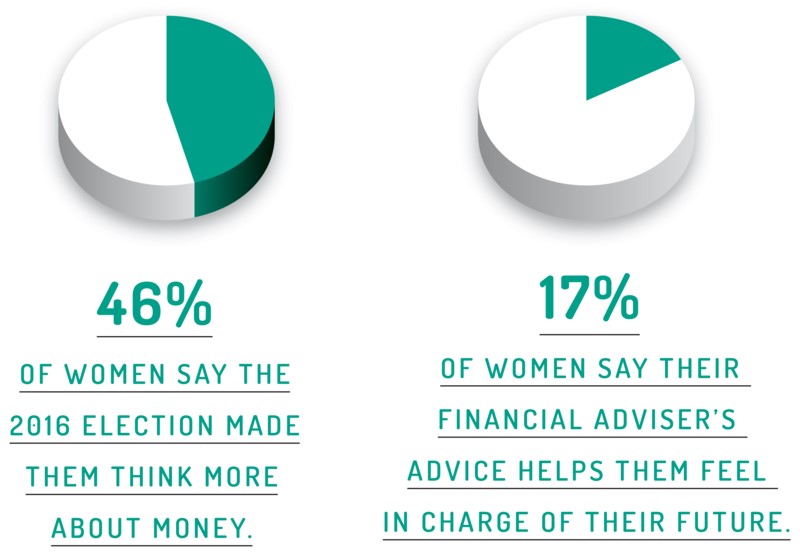

The survey results illustrate what she’s talking about. Fewer than half of the women surveyed felt satisfied with their knowledge of finances, they said. And just 17% reported being satisfied with the advice of their financial adviser. Women tend to live longer than men and retire with less money. Yet, the finance world remains profoundly oriented toward them, Krawcheck says.

Ellevest conducted the online survey with research firm Chadwick Martin Bailey in November 2017. Of the 1,034 women polled, 22% were women of color. In total, the survey polled more than 2,000 U.S. residents aged 22-65, all of whom had personal incomes of $50,000 or greater and were involved in managing their personal or household finances. More than 90% of the survey’s participants were over the age of 30 and 200 identified as LGBTQ.

Keep reading for a snapshot of what women say needs to change in the world of money.

Forty-eight percent of women surveyed said they agree with the statement that, “Most women have to work twice as hard to get half as much.”

Almost half of all women said the 2016 election caused them to reevaluate their financial situation. Perhaps relatedly, only 17% said their current financial adviser helps them feel “in charge of their future.”

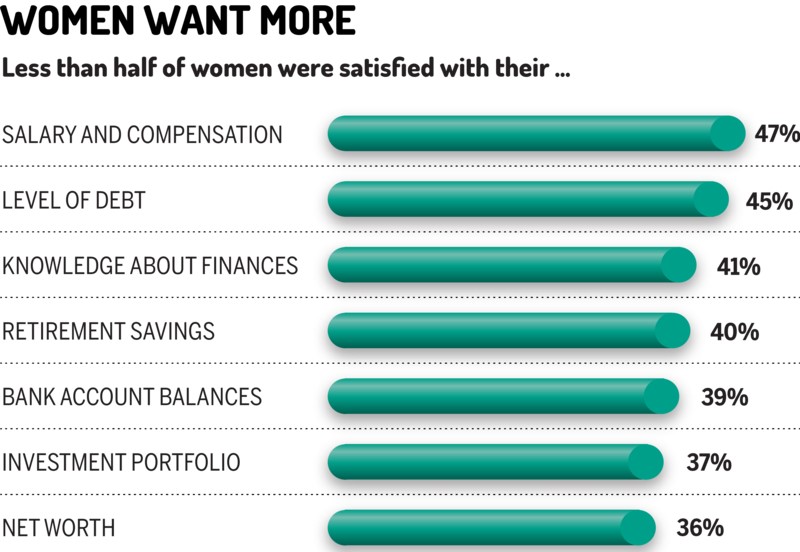

From salary to debt, women are feeling left out

From salary to debt, women are feeling left outA majority of women are dissatisfied with virtually every aspect of their financial lives: Just 36% are happy with their net worth, 37% with their investment portfolio and 40% say they were satisfied with their retirement savings.

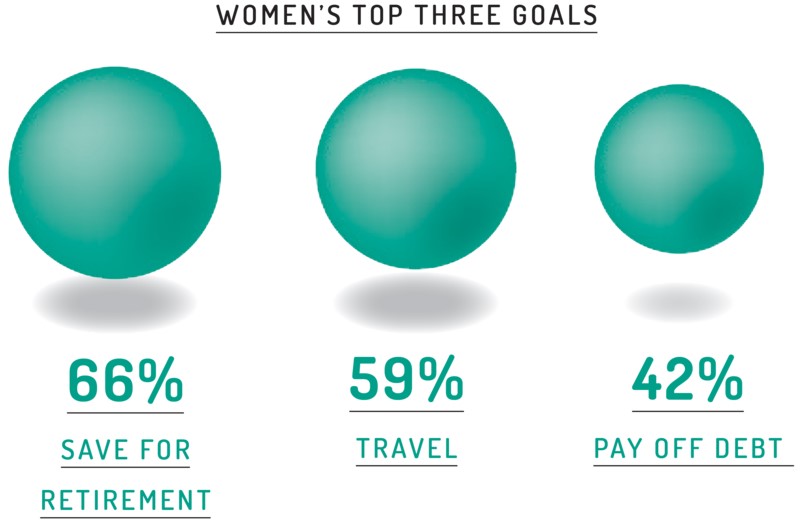

#goals

#goalsWomen have very clear financial goals—ones that may be different from their male counterparts. Sixty-six percent say their goal is to save for retirement. At the same time, 59% say they want to have enough money to travel. Forty-percent say they want to be able to pay off debt.

Ellevest found that just 47% of women say they know how to achieve their financial goals.

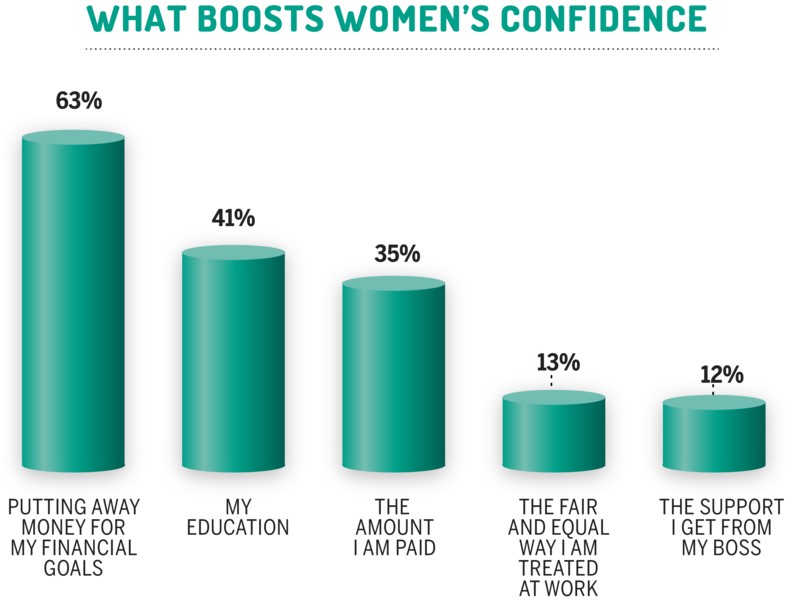

Asked to name what most boosted their confidence, women were most likely to respond, “Putting away money for my financial goals.” That’s not to say the other categories weren’t important, but it’s clear women value the feeling of being financially savvy.