It’s about a 6 min. read.

Back in the day, if you had a little money to invest, you called up the brokerage firm that your dad used, you talked to his“guy” and you asked him to invest your money for you. Those days aren’t totally gone, but over the last few years new technology has disrupted the traditional investor-client relationship—resulting in more ways than ever to invest your money yourself.

We all remember the iconic E*TRADE baby from way back in 2013. E*TRADE’s campaign brought the online discount stock brokerage firm for self-directed investors model into the mainstream. Since then, more DIY investment platforms have cropped up, each vying for the modern self-directed investor’s business. But one important learning from the DIY trend of the past decade is that even though this model lends itself to independent investing, DIY-investors still need some type of investment help.

The first robo-advisor was released in 2008 to help these new investors make smart money choices. For the most part, early DIY investors didn’t have a formal finance background, so robo-advisors offered them portfolio management services and insights that were once reserved for high-net-worth individuals—at a fraction of what a traditional human financial advisor might charge. It was a gamechanger.

Robo-advisor technology continues to shape the financial services industry with big players like Charles Schwab and Ameritrade each launching their own in the last few years. This growing interest and investment in robo-advisory technology is great for DIY investors and offers a ton of opportunity for traditional financial firms be on the cutting edge of FinTech.

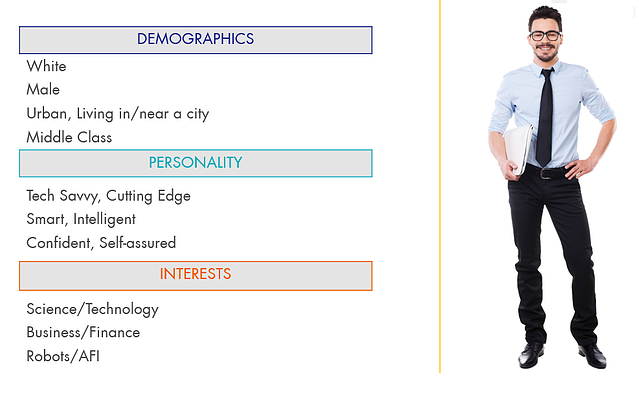

Given the changing landscape, we wanted a better understanding of investor perceptions of robo-advisor clients. Through our 2017 Consumer Pulse, we surveyed 2,000 US adults about FinTech, traditional financial services firms, and who they perceived as the technologies’ typical user.

CMB’s AffinID (a measure of social identity’s influence on consumers) score for this FinTech offering indicate that while all three components of AffinID (clarity, relatability, and social desirability) could stand improvement within the investor community. Relatively speaking, relatability is weakest–people have a clear image of what the typical robo-advisor user is like and that image is socially desirable, but they don’t view the typical user as part of their “tribe”.

The inability of investors to relate to their image of the typical robo-advisor user sheds light on a potential roadblock. Robo-service providers targeting traditional investors might consider messaging that conveys a typical user more closely aligned with the “traditional investor image”.

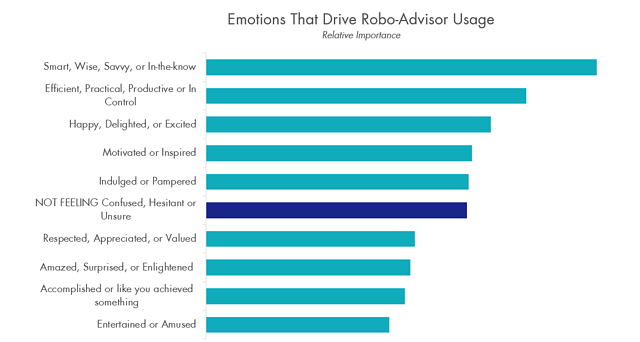

We found that robo-advisor users themselves are driven by feelings of being smart, wise, and savvy, efficient, practical, productive. Inspiration and motivation are also key emotional drivers for robo-advisor services.

Why does this matter? It tells us what brands looking to differentiate themselves in a crowded FinTech market could be doing to attract more customers. These emotional drivers could be important messaging elements for those companies looking to court new money from traditional investors.

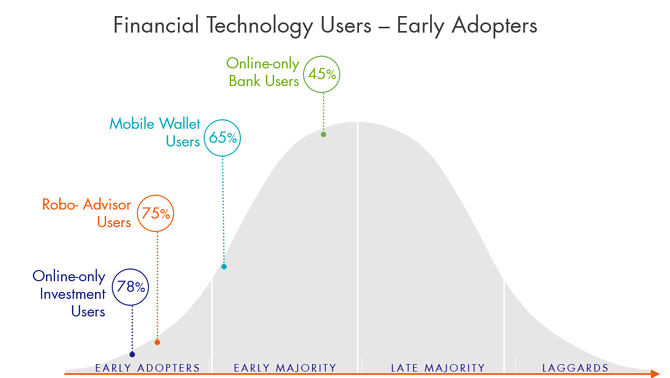

Three quarters of robo-advisor users consider themselves early adopters, this is in contrast with users of mobile wallet and online-only banking–two technologies that have entered the mainstream. As traditional financial service providers make considerable investments in driving robo-advisor adoption, our findings show that to drive adoption it’s critical to understand both how consumers want to feel, and how they perceive and relate to their image of the typical user.

Our comprehensive FinTech study also looked at online-only investment apps, online-only banking, and mobile wallets. Download a sneak peek of our findings from all four in our Facing the FinTech Future series: