It's about a 5 min. read.

By most measures 2020 has been a sharp stick in the eye. But Millennials and Gen Zers have had it especially rough– in fact, they’ve experienced economic, environmental, and political upheaval for most of their lives. Many have never known a time when the United States was not at war with someone. They arrived to the party with a certain baseline of anxiety and fear shaped by the world and personal events throughout their formative years. As they say, “change happens in a crucible” (thanks, Mack Turner), and with the added stress of the pandemic, many young investors took their anxiety and fear and boldly channeled it into a new proactive approach to investing. They were determined not to miss the market sale, as many of them did for one reason or another back in ‘08/’09. New account openings were at an all-time high this past spring for traditional financial services brands and the plethora of born-online digital platforms.

With this new focus and new money floating around, coupled with the stark realization that the markets go in both directions, these new investors need knowledge and guidance. Many firms have stepped up and made significant efforts to provide both to these less affluent newbies. But the final answer to an important question remains, who will they trust most with their future? There are two knee-jerk responses to this question: (1) the storied and well-established institutions that have reached a hand to these new potential customers OR (2) the born-online, new, fresh tech platforms targeted to these digital natives.

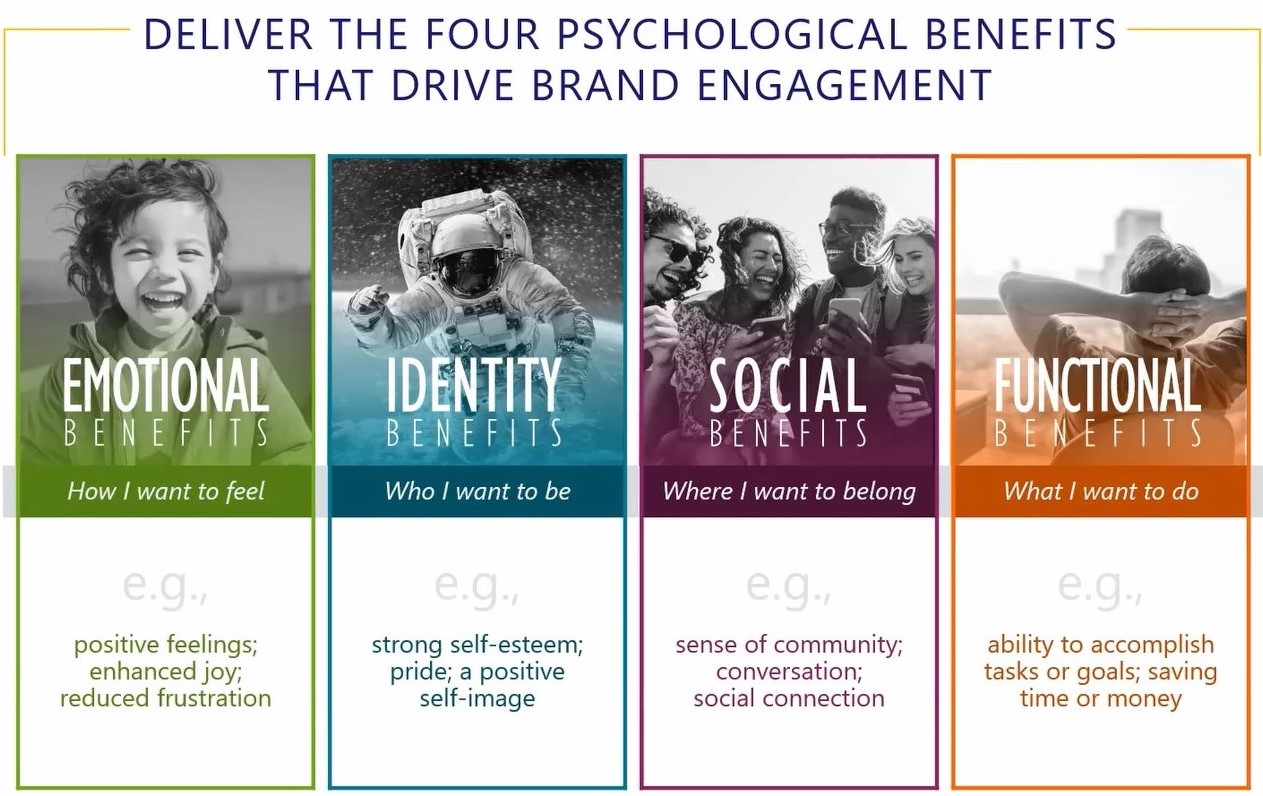

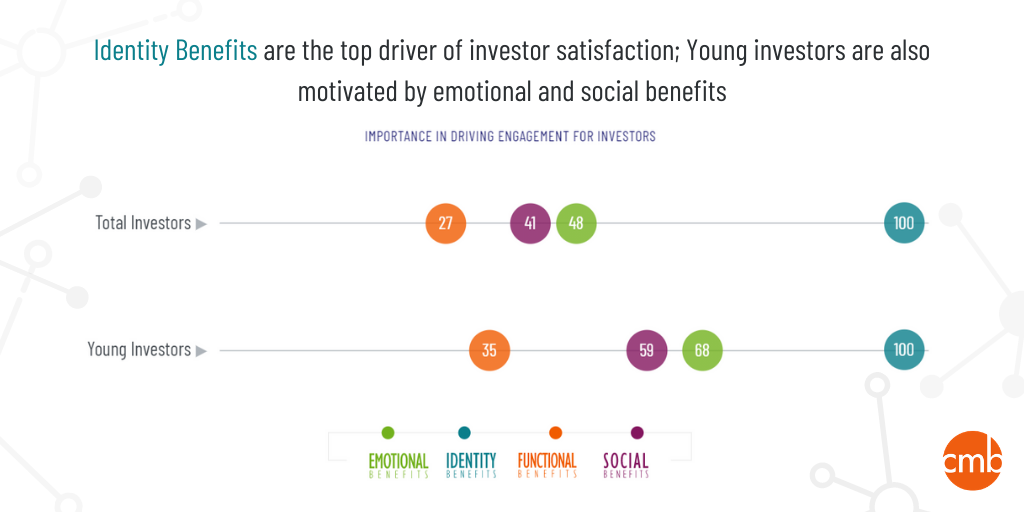

There’s good reason to choose either of these options as the answer. However, investment firms must consider the four psychological benefits that drive brand engagement: emotional, identity, social, and functional. For brands across industries, leading prospects to expect these benefits drives consideration and delivering these benefits to customers drives loyalty. And, for investment firms—disruptors and established alike—these psychological benefits are the key to winning the hearts and wallets of young investors.

We know that financial services brands (traditional or digital) deliver against these four pillars with varying degrees of success. However, there are other players outside of financial services and fintech that bear consideration and a watchful eye (and which already deliver important drivers of engagement in spades). Tech Brands like Apple, Google, and Amazon already have the attention of young investors in other aspects of their lives. Further, some have begun to make forays into financial services through the offering of credit cards and mobile payments. It may be a short reach for them to move their customers into high yield savings and investing through partnerships, purchases, or built-from-scratch offerings. While there are certain barriers in place to jumping in with both feet, the strength of these brands warrants a watchful eye.

So where do financial services firms start? Functional benefits are table stakes, so delivering those benefits alone isn’t enough to attract new investors. It’s therefore crucial for brands to deliver the identity, social, and emotional benefits to drive engagement. Make young investors feel safe and secure (emotional benefits) through every touchpoint. Find a way to help them to express themselves (identity benefits) by ensuring that their financial brand aligns with their values and help them to connect with others as they embark on their investing journey (social benefits).

As detailed in our latest report: Get Inside the Mind of the Young Investor, here’s what you can do so that you don’t miss out on the young investor:

Don’t forget to immerse yourself in our latest financial services research: Get Inside the Mind of the Young Investor. And stay tuned for more of our findings—experiential and beyond.