It’s about a 6 min. read.

Today’s executives are investing money, mind- and man-power into cracking the code of the Empowered Consumer. Every client I speak with understands the importance of developing a consumer-centric culture and strategy, and they are putting millions into making this a reality. But there’s a pervasive problem affecting brands across industries—while research and insights have generally kept up with this evolution in consumer-centric thinking (witness the growth of ethnographic work and customer journey mapping), brand tracking has not. Most brands are still tracking their brand health through measures focusing solely on their brand and not on the consumers.

Just as retail stores are transforming their floor plans and service firms are overhauling their operations to enhance their customer-centricity, today’s brand health measurement and tracking needs to change, too. Trackers must put the consumer first and uncover how well consumers see “what’s in it for them”—specifically—how they benefit from being a customer. This is why we’ve introduced a truly comprehensive and holistic approach to consumer-powered brand measurement—BrandFx.

BrandFx focuses on what consumers want from a brand—the benefits driving purchase, loyalty and advocacy—and provides specific guidance and critical, concrete recommendations on what to (and what not to) communicate:

It’s true that many brand trackers already cover elements of this approach. For example, some have transformed their functional brand attributes into functional benefits, and new thinking about the role of emotion in purchase decisions has led to a battery of emotional benefits in a growing number of trackers.

However, very few have incorporated benefits associated with consumer social identity, and as a result, they are missing out on a critical piece of the brand puzzle: The more the image of a brand’s typical customer represents a “tribe” they connect with or aspire to be part of, the more that consumer will try, buy, and recommend the brand.

Our research shows that, when consumers identify with their image of a brand’s customer, they are 12-times more likely to consider the brand. And our proprietary assessment of a brand’s performance on these Identity benefits, AffinID, has proven to be a better predictor of brand engagement than the standard brand tracking metrics (functional and emotional) most brands rely upon.

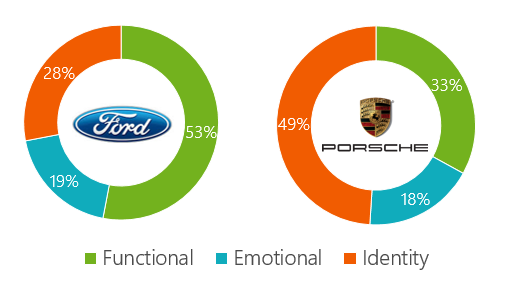

Advanced analytics provide insight into how these three types of benefits—Identity, Emotional, and Functional—fit together to explain how they drive the key outcomes of consideration, purchase and loyalty. In the example below we see how benefit composition varies by brand—highlighting key areas for differentiation.

After three decades of refreshing and reviving brand measurement programs, we know the challenges for insights professionals charged with running trackers. Some of these are technical (making 30-minute questionnaires mobile-friendly), and some of these are strategic (balancing trackability with addressing the needs of a changing market). Brand tracking programs need to be designed with the flexibility to meet these challenges through analytics, technology, and thoughtful strategic planning. We understand these challenges and specialize in working with clients to tackle them successfully.

The bottom line is that consumers aren’t conducting business as usual and brands can’t afford to either.

Does your brand measurement have a blind spot? Join CMB’s Mark Doherty and Kate Zilla-Ba for a webinar: BrandFx: Consumer-powered Brand Measurement to learn more about transforming your brand measurement program into one that is truly consumer powered

Watch Now