Insights teams have never been in a better position to help companies navigate the different (and sometimes competing) priorities of Brand Strategy, Product Marketing, Product Management, Engineering, and Business Planning groups.

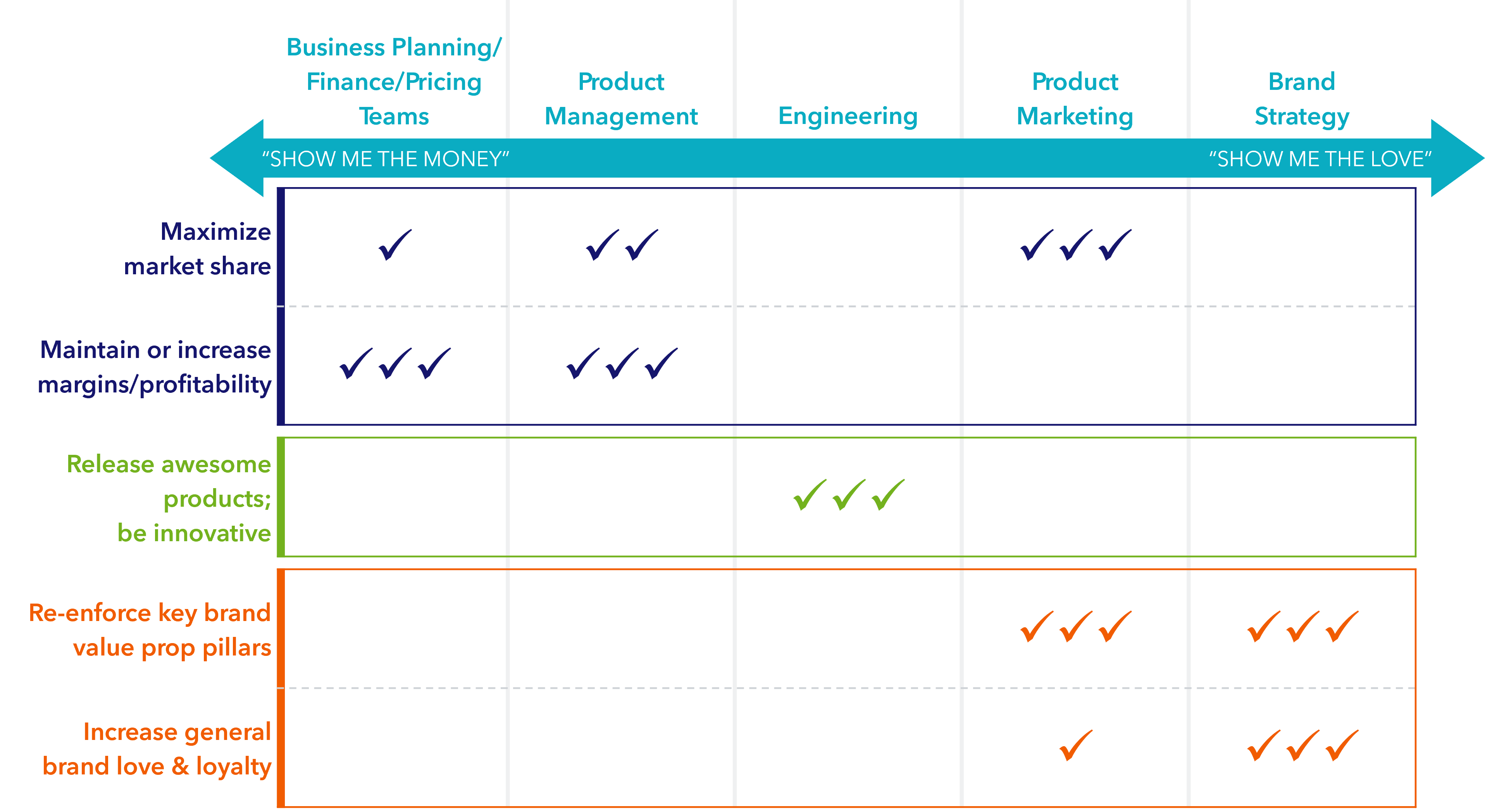

In most new product development or pricing/packaging workstreams, the end-goals of the various stakeholders look something like this:

And over the last 12 months, sales in many product categories have slowed, supply costs are up, and inflation has eroded consumer buying power. The tension between Business Planning (“raise prices”) and Marketing (“increase brand love”) is palpable.

Enter the Insights team, the plucky heroes of our story.

Historically, the Insights toolkit has often used conjoint analysis to guide pricing and packaging decisions to help clients maximize market share and and/or profitability with cold hard features, functionality, and pricing. Then product branding, market messaging, and general brand love are tested and measured separately.

There are tools to analyze these in the very same, wonderful Bayesian sandbox. For instance:

The resulting simulators test how various feature combinations, price points, promotions and discounts enforce or detract from brand associations and brand attachment right alongside market share and profitability considerations. They are also good at testing “product slimming” scenarios (e.g., maintain a steady price but trim some of the cost-inducing features that most people can live without…or “shrinkflation”…along with seeing how these scenarios impact your brand equity.

All of this is particularly important now due to persistent inflation and consumer uncertainty. During times of economic turmoil, smart insights can help bring inner peace to your company as it navigates complex and risky trade-offs. Contact us today.