It’s about a 6 min. read.

We attend conferences to meet colleagues, present our latest and greatest, and learn more about new methodologies and approaches.

I’m just back from this week’s Quirk’s Chicago Event with its top of the line content, and I’m ready to recap some memorable moments from the conference.

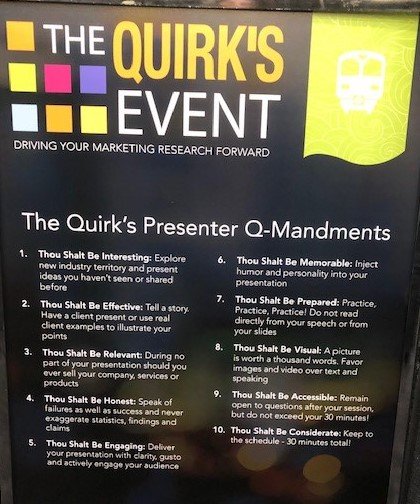

This being a Quirk’s Event, here they are organized by the “Ten Quirk’s Q-mandments”:

Walgreens and Verve presented “Big Data and Small Qual: Amazing Best Friends.” Andrea Golightly presented the evaluation of MedExpress (Key Research question: Is MedExpress a good complement to work with Walgreens Pharmacy?) In the big data phase, they assessed how a partnership would affect equity, traffic, and sales at Walgreens. They reviewed scanner, panel, social media, day parts, categories, and customer cohorts to size the opportunity. The findings yielded that they generally met expectations. Next, stakeholders asked: why isn’t the prediction even better? They conducted “small qual” through their Verve panel. Through open-ended online qual, they found consumers noticed the parking lot was busier than usual, so they’d drive past the Walgreens/MedExpress.

Mark Garratt from In4mation Insights spoke about how companies need to use Social Media Data to predict new product success. He explained that social data projects take >1M unique posts to predict sales if they can align the words, sentiment and the motives. For example, to sell vegan organic food, a company needs to see certain tipping points of particular words, sentiments, images and motives.

Nestlé talked about applying agile principles to achieve product innovation success. In this presentation, Dawn Ferfolia, Innovation at Nestlé, and Molly Wright, from GutCheck, talked about how they used flexible agile solutions to drive faster time to market, spur collaboration, and drive iteration, reflection and optimization. We even tasted a product, a chilled power bar that resulted from this pipeline change.

Joel Benenson spoke on how the rules from the political war room can also be applicable to brands. The presentation clearly described how vital it was to stay on point. First, it’s essential to know what the campaign is really about. He went on to say that for politics and for brands, our greatest strength is usually our greatest weakness. We need to understand our competitive framework, that values matter (ours and theirs), and we need to have principles before policies. He said if we want to position ourselves, it’s critical to know it’s about more than just a horse race. Winning brands and winning leaders define winning on our terms; and we know the voters we need to win. His research delved deeply into the attitudes and beliefs of the base.

Jonathan Williams from Discover.ai talked about how brands can use AI on more open-ended tasks (vs. close ended, rule based, logical questions such as “Why do people like chess and how do we get more people to play”). As a proof point, he explained how they helped DeBeers use research to reinvigorate diamonds as symbols of love in today’s world. Although diamonds are forever, they are losing to other luxuries as a category among Millennial and Gen Z. This research yielded 15 springboards or hunting grounds, including the notion that diamonds are a sign of commitment, creating a wow moment, and being responsible, ethical, and earthy, etc.

Modeling the many paths to purchase to improve marketing efficacy involves delving into the adjacent field of biology for LRW. They’ve used a DNA sequencing-like statistical analysis to figure out similarities and differences between journeys. Much like a small change can drive the DNA sequence to create a frog vs. a bird, the sequencing helps differentiate the journey. Once journeys are established, they create profiles. In a case study they presented (brand was omitted), LRW found seven fundamental journey groupings (price driven, relationship driven, website driven, offer driven, location driven, digital driven, security driven) and tied these to economic potential and the messaging most likely to drive intended behaviors.

We learned about the three phases of data democratization from Debbie Fischer of AFI and Kristi Zuhlke CEO of KnowledgeHound. According to them, data democratization means making data and insights available to the broader organization. Millennials make up 35% of the nation’s workforce and expect to Google or use something like Knowledgehound to figure things out on their own. AFI says they’re growing from data adolescence to data maturity and encourage others to “cross over”.

RealEyes and EmotionAI work with Sunil Soman from Warner Entertainment. Together they conducted a branded content study of 20 videos and 20 thirty-second ads. They analyzed videos through both passive measures like attention (volume and quality) and emotion (feelings), and active measures such as sentiment (automated analysis of response after viewing content) and survey (ask specific pre- and post to gain extra layer of insight). This work helped guide more relevant advertising targeting. Finally, their goal was ultimately to help create and distribute meaningful content.

Insights Strategy Group presented on why Gen Y and Z value happiness, friendship, money, being well-liked and dating. These age groups strive to have enough money to live the lifestyle they want to live, find a job they actually like, and express feeling helpless about what’s going on in the world. Both Gen Y and Z report happiness as their number one goal, unchanged from 2013 to 2019. They also report a 27% decline in valuing being well-liked and a 39% drop in valuing who they are dating/married to as they aged from 2013 to 2019.

And of course, it’s not all about the presentations. CMB sponsored the Exhibitor’s Lounge to help provide our market research and insights industry peers with a place to work, eat, rest and talk during the conference. There, and in booth city, we met and reconnected with suppliers, friends, colleagues and partners.